Let’s Talk Business

Hah! I got you there! There’s no art in this article. Don’t get mad though, ‘cause this article just might help you. Well, I think it definitely will.

Okay, so maybe I won’t be talking about the “art” of registering your online business with the government, but I will discuss the how’s and why’s, so please forgive me.

I’ll try to discuss this as light as I can, this is a subject boring enough (I know), so I’ll try to explain everything in layman’s term. Please bear with me.

Hey, pay attention. You need this.

We’ve already posted a detailed article about types of business registration and the process so I’m just going to do a recap in this article since this is focused on online sellers.

If you want to read the past, more comprehensive article on Business Registration later on, click here.

Please take note that the process discussed in this article and the past is only applicable in the Philippines, you may want to ask your respective local authorities if you reside in a different country.

Let’s Start

Soooooo you’ve finally found something you’re good at, and you think you’re good enough to turn it into a business. Maybe baking, cooking or handicrafts.

You’re planning to sell these online since you want to start out small, or just doing it for a past time or extra income. You might have started thinking of this during the quarantine period for an alternative income.

You may be one of those whom already started and is doing quite well. Good for you.

Suddenly, here comes the BIR (Bureau of Internal Revenue), requiring all online sellers to register their businesses and (guess what?) pay their taxes! Surprised? You shouldn’t be.

Now the social media has gone crazy, panics, different opinions clashing, but at the end of the day, we have to obey the law and do what is right.

You see, tax is the government’s life. It is what runs our nation. Without taxes, our country would go bankrupt and simply cease to exist.

As business owners, we have certain responsibilities, and other than the responsibility to our clients is the responsibility to our government.

Should I Do It?

What? Register your business? I think you definitely should.

As they say, business is business, no matter how high or low your profit may be.

Well, you may opt not to, but since registering your online business has now become mandatory, that would make it illegal, amigo. You wouldn’t want the law coming after you, would you?

Look at the bright side, registering your business gives it more potential.

How? Well, look at it this way, registering your business will make you and your business legitimate. Yes, legit.

With the popularity of online selling, opportunists and scammers had undoubtedly joined the pool of online sellers. Registering your business will gain you more trust from potential clients, as people will have a sense of security once they learn your business is legitimate. This will separate you from doubts people have whenever they do an online transaction.

What else? This will be a part of your asset. If you didn’t have a job as of the moment, being self-employed may entitle you to things a person with a day job is entitled with. Like loans.

If you didn’t have the paper to back you up, you have little to no chance of being approved for a loan. So, this definitely will be another opportunity to expand your business. Nice.

This also gives you a chance to establish a name or a brand. Rather than seeming to sell just random stuff, along with your talent and skill, your brand grows with you, because you are your business.

Okay, now I’m about to give you a quick recap on how to register your business on step by step process.

Again, this article is focused on home-based online businesses so this will all be about SOLE PROPRIETORS.

Registering A Business Name With DTI

Every business needs a unique name, and DTI or the Department of Trade & Industry is where sole or single proprietors register their business names. DTI has its rules with choosing business names, like nothing too general as a business name. For example: “Paint Store,” for a store that sells paint. Duh.

Business names with seemingly vulgar words are also not allowed, for obvious reasons, and a couple more which I doubt you’d be having problems with.

THINK OF A BUSINESS NAME – Obviously, this is the first thing you do. Think of at least three choices just so you won’t have a hard time if your first choice isn’t available or is already taken. This is necessary only if you process it in the DTI office as you will fill up the forms including the three choices of names you have in mind and they search and type it up for you.

Online, otherwise, you can check on your own and search for availability as you please.

Play with words. Something on point, like

- Juan’s Cookie Haven

- Juan’s Cookie Corner

- Juan’s Cookies Galore

CHECK BUSINESS NAME FOR AVAILABILITY – Chances are you have someone who has the same name as you and uses it as a business name as well. Best thing to do is search in the DTI’s BNRS or Business Name Registration Service site to check whether the name is taken or not. You may try it out here.

FILL-UP FORM AND PAY– Yep. Choose the territorial scope of your choice. Whether municipal, regional or national. This costs at 500, 1000 and 2000 pesos respectively.

Since you’ll be selling online in the hopes of shipping your goods all around the country, I think it’s best to register your business name in the national scope. Makes sense, right?

Other than that, you pay 30 pesos for documentary stamp. That’s it. That’s all you need to pay.

If you had it processed in the DTI office, you may pay over the counter. If you registered online, which I suggest you do as it is faster and more convenient, you may pay through, GCash, PayMaya or credit and debit cards.

RECEIVE YOUR CERTIFICATE – I received mine right after I paid. That Easy. Last time I did this online, it took me less than 30 minutes from business name verification to receiving my certificate.

If you want to process your DTI registration online, you may do so here.

Now that your business has a name, let’s go through the permits so your business can operate.

Shall we?

Local Permits

Okay, registering the permit doesn’t give us the right to operate, YET. Of course, we need necessary permits for the government to allow us to run the business.

Where do we get business permits, you ask? In our respective Municipal or City Hall. Business Permits sometimes referred to as Mayor’s permit are granted by the City Government in which your business will operate, not your residence.

How do you get granted with such? Tadaaaahh! Requirements. Complete Requirements.

Now this is just a guide and requirements may vary from different barangays and cities. Nonetheless, you may want to get these things ready as you will probably need it.

BARANGAY REGISTRATION/PERMIT – Before the big hall, you will first have to register your business in the barangay hall wherein your business will operate. How do you get it and will you need to present?

Head on over to your barangay hall and fill-up a form. With your duly filled application form, you will have to have with you:

- Business Registration Certificate from DTI

- Two (2) Government issued valid ID’s, and

- Contract of lease if renting a space, or Certificate of Land Title if the space is owned.

The next step is to pay fee (if applicable) and wait for your Barangay Certificate or Clearance to be released.

Now like I said, these may vary. So just get these things ready.

Once you’ve got a hold of this, you may now head to the City hall.

BUSINESS/ MAYOR’S PERMIT – Now this is just like what you did in the barangay but bigger and with a bit more process.

Head on to your Municipal/City Hall’s permits section, fill-up necessary forms, and submit with the following:

- Barangay Permit/Clearance

- Business Registration Certificate from DTI

- Two (2) Government issued valid ID’s, and

- Contract of lease if renting a space, or Certificate of Land Title if the space is owned.

After all this you will not get your permit right away. Staff of the city hall MIGHT have to assess your place of business first to properly be assessed on how much you will be due to pay for the permits, as this could vary to this size of a starting or existent business (if in renewal process.)

The government doesn’t want you to over nor under pay.

I repeat, this may all vary on a case to case basis.

Now you just have to wait for everything to be approved, pay the necessary charges, and wait for the arrival of your permit.

Bravo, you are now registered to the city!

But wait, one last step! One final application and you’re on your way to running your business.

This might be the most dreadful part, but hey, it’s the reason why we applied for all those permits, isn’t it?

HELLLOOOOOOOOO BIR!

Registering Your Business With BIR

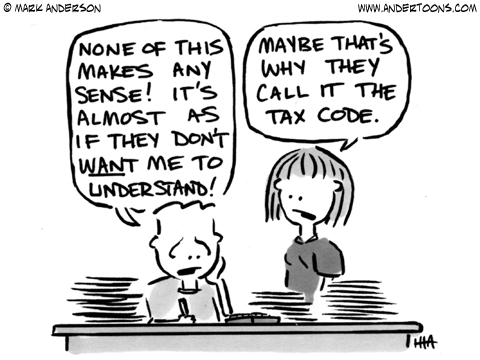

Of all the necessary permits and applications, BIR registration may be the most intimidating of all. Probably because not everybody can understand how tax works.

I’ll discuss that in a while, plus we had a live webinar with Ms. Grace Parazo and our friends from taxumo.com who explained to us, how online sellers will be taxed, and some Q&A’s about tax, you can watch the video below later on.

For now, let’s register with the Bureau of Internal Revenue!

First, head on to the BIR RDO (Regional District Office) that is in charge of the area in which you will put up your business.

Fill-up BIR Application Form No. 1901 (specific form for sole-proprietors), you can do this beforehand by downloading the form here.

Now submit the duly accomplished form with the following:

- Barangay Permit/Clearance

- Business Registration Certificate from DTI

- Business/Mayor’s Permit

- Two (2) Government issued valid ID’s, and

- Contract of lease if renting a space, or Certificate of Land Title if the space is owned.

Next, pay the Registration Form with BIR Payment Form No. 0605, which you can download here.

Register your books of accounts and receipts or invoices.

Finally, after accomplishing all your requirements, and paying all the fees, claim your BIR Certificate of Registration, Form No. 2303, which you can’t download anywhere as it is a printed certificate.

Congrats! You are now a legitimate businessman! Or woman.

Woohoooo! But let’s try and talk about what every aspiring entrepreneur is scared of:

Tax

So, with the recent banting on the internet, and discussions on whether it is fair to tax online sellers, here is the simplest explanation I’ve come across. Thanks to Mr. Nicko Soriano.

Upon registering with the BIR, you have a choice on which type of tax will suit you best, and it’s best to ask your RDO since they can asses you best regarding your business and situation.

Registering your business with the BIR doesn’t necessarily mean you have to pay taxes.

How is this? Here’s the types of taxes once we’ve registered.

Income Tax

UNEMPLOYED – if you are unemployed and earns solely from online selling, you have a choice of:

- 8% Income Tax – The first 250,000 pesos sales or gross receipt (per annum) is exempted or non-taxable. Choosing this option will exempt your sales/receipts from 3% Other Sales Taxes.

- Graduated Rates (0-35%) – based on Taxable Income, all capital, costs and expenses will be deducted for the computation of tax.

EMPLOYED – if you are employed and doing business as a sideline:

- The first 250,000 pesos will no longer be exempted as this will be used in your work income, wherein the first 250,000 pesos in the tax table has an applicable rate of 0%.

- The taxable income from your business will be added to your work income, then the graduated rates shall be applied.

Business Tax

VAT – if your actual gross sales or receipts are exceeding 3,000,000 pesos, you will be required to register for a business tax with 12% VAT or Value Added Tax, but there are exemptions to this under Section 109 of the Tax Code.

Marginal Income Earner

What is this? Being a Marginal Income Earner or MIE means, having less than 100,000 pesos in gross sales or receipts per annum. This simply means non-taxable and no 500 pesos registration fee.

Do you still need to register with the BIR? YES.

Moving On

You just need to inquire and talk to your local RDO, really, you’d get to ask questions and get the answers you need. Sometimes different RDO’s require different things and assess differently.

So, it’s best to go to them directly. After all, this will all benefit you in the end.

Not All Heroes Wear Capes

If you’re really having a hard time with taxes or just plain don’t have the time to process and understand it, did you know there’s an entity that can help you with it?

TAXUMO. What is Taxumo?

It is an online tax service that works directly with the BIR to help you out from application to tax computations to payment schedules and payment. They will help you out with your books as well. Lovely isn’t it?

No matter how busy you are, Taxumo will help you with your personal or business taxes.

Say goodbye to headaches and penalties due to late payment.

They have different packages for different types of tax work and you may check more about them and their services here.

Another good news! Because The Bailiwick Academy wants you to feel good after the taxing issues, you may use the promo-code “bailiwick” to get 10% off any of Taxumo’s packages. Feel better now?

Here is the video of the live webinar about Business Registration and Tax Filing for Online Sellers conducted by Ms. Grace Parazo of The Bailiwick academy with the help from our friends from Taxumo, Mr. EJ Arboleda and the gang:

So what are you waiting for?

Start working on your legitimate business and start earning!

Peace!

Pingback: Food Business in the Philippines: 5 Reasons to Start One!